ESG Building Blocks

Sustainable finance is a pragmatic approach that incorporates environmental, social and governance (ESG) considerations into financial decision-making to address global challenges. Valued at $5.49 trillion in 2023, the sustainable finance market is projected to grow to $38.19 trillion by 2034. Sustainable finance initiatives include ESG-focused asset investment and management, social impact investing, green investments/bonds, and sustainable banking.

Flows Towards Decarbonisation

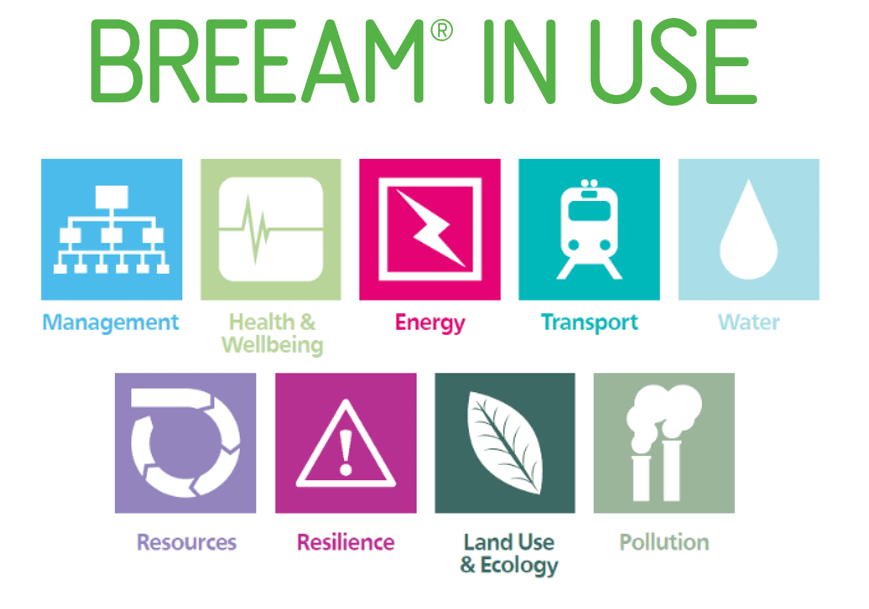

Sustainable finance market growth is dominated by European organisations such as the European Investment Bank (EIB), contributing €44.3 billion in 2023 towards sustainability and climate action. The EIB’s >€1 trillion for <1.5°C paper outlines its goals for sustainable finance investments, including the Energy Lending Policy to support decarbonisation of the energy supply. Sustainable finance also incentivises the construction of energy-efficient buildings through financing green building certifications. BREEAM Certification Schemes account for an 80% market share in Europe and align with the EU Taxonomy for sustainable practices. This establishes greater compliance, standardisation, and offers sustainable finance opportunities for BREEAM-assessed buildings, as explored in the BRE (2022) A Guide to the EU Taxonomy and BREEAM.

Additionally, the UK government’s Green Heat Network Fund (GHNF), a £288 million grant, provides funding towards decarbonising the heat network. Exeter Energy Network received £42.5 million towards building a Low-to-Zero Carbon heat network using air-source heat pumps and a high-temperature water source heat pump. Connecting homes and buildings to this network is expected to reduce CO2 emissions by 65-75% compared to gas heating. By directing sustainable finance to energy efficiency schemes, the GHNF helps contribute to the UK’s goal of achieving net-zero emissions by 2050.

Investing Responsibly

A major driver for sustainable finance is ESG-related asset management and impact investing. Aviva Investors, a global asset manager, surpassed its target to finance £1bn in sustainable real estate after extending a £227 million ESG and sustainability loan to Romulus investment firm. The loan’s favourable borrowing rates are contingent upon meeting sustainability-related KPIs and evidencing measurable sustainability improvements in lent assets.

Asset managers aim to create ESG policies and targets to improve the profile of their investments, to consider long-term risks, and to report on ESG performance. They face key challenges in ESG reporting including lack of standardisation in reporting methodologies and insufficient transparency in ESG data and policies. A survey completed by 300 US and European asset managers, titled Measurable Impact: Asset Managers on the Challenges and Opportunities of ESG Investment concluded that 64% of asset managers reported insufficient transparency and disclosure in ESG activities. This limits the extent to which asset managers can evaluate their fund’s ESG-related performance, assess risks and precisely direct sustainable finance investment. To meet growing investor demand, fund managers are increasingly reporting on their ESG via benchmarks such as GRESB, which commit to transparent reporting and third-party verification.

Sustainable finance holds immense potential to drive the transition to a sustainable built environment. However, realising this potential requires greater standardisation of regulations, more effective funding allocation and enhanced transparency in ESG reporting.

Originally published Transform Dec 2024 © IEMA

Other Articles

October 14, 2025

Envision’s BREEAM in Use Market Position

Envision is a leading provider of BREEAM in Use assessments with the UK. We provide quality advice…

October 13, 2025

Carbon Footprint Report and Reduction Plan 2024-25

We are pleased to release our 2024-2025 Carbon Footprint Report and Reduction Plan. This marks the third…

October 8, 2025

Junior Sustainability Consultant

Introduction We politely request that recruitment agencies do not contact us regarding this position.We are currently seeking…